When you run into an uncleared check preventing a successful reconciliation, here's what to do: You can continue recording checks you've written as usual, using the bank account as the Account in the expense transaction.

The Money in Transit account currency should be the same as the bank account the checks are written from.

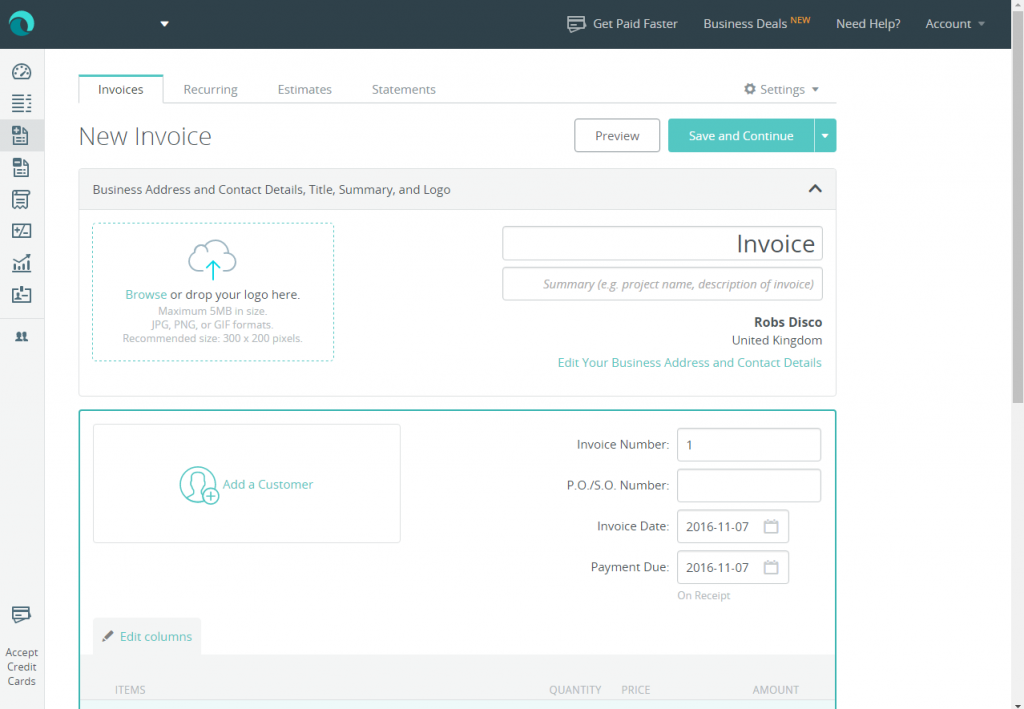

Transactions in Money in Transit accounts are included in the Cash Basis numbers for reports like the Profit & Loss and Balance Sheet, and they are also included in the Cash Flow report. You can find Money in Transit accounts on your Chart of Accounts page, within the Assets tab under the Cash & Bank section. Money in Transit accounts represent transactions that are headed to or from your bank account, but haven't cleared yet, so for accounting purposes, these transactions are considered cash activity.

How do Money in Transit accounts work in Wave? There is also another option of using a Money in Transit account. You can change the date on the check transaction to match the date it clears the bank, or use the imported transaction from the bank feed as your record and skip recording it ahead of time. However, outstanding checks that clear after the bank statement closing date will throw your reconciliation off. This is because Wave compares all transactions in the bank account to the bank statement balance when it matches, your account is reconciled. If you've ever written a check from your business bank account, at some point you've probably run into a problem with your bank reconciliation.

0 kommentar(er)

0 kommentar(er)